According to the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), chicken -- already the most popular meat in the country -- is expected to not only be consumed more over the coming years but to be increasing chosen over other meats. By 2019-20 Australia’s chicken meat consumption is expected to stand at 1.32 million tons.

This is particularly positive news for the country’s poultry meat producers. Chicken meat cannot be freely imported into the country, meaning that greater consumption must go hand in hand with greater production and, as approximately 96 percent of Australian output is consumed locally, the industry is particularly sensitive to local demand fluctuations.

What little export business does exist comprises primarily frozen cuts and offal, with the main export markets being Papua New Guinea and the Philippines. Alongside growth in home consumption, demand for Australian chicken meat from overseas is also forecast to grow – from 40.5 tons this year to 47.4 tons in 2019-20.

High per-capita chicken consumption

In 2013-14, Australian consumers ate 1.08 million tons of chicken meat, making them the third highest per capita chicken meat consumers – behind Malaysia and Jamaica – in the world. This year, per capita chicken meat consumption is expected to increase by 2 percent to stand at 45.4 kg and by 2019-20, per capita consumption is forecast to reach 49.2 kg.

Australian consumers are increasingly favoring higher-value chicken products, such has fresh whole birds and ready-to-eat cuts.

Chicken meat is competitively priced compared with other meats in the country, and ABARES notes that, over the past two decades, the price of other meats has risen very strongly relative to chicken meat.

Over the five years to 2014-15, chicken meat was on average 50 percent cheaper than pork, 59 percent cheaper than lamb, and 65 percent cheaper than beef. Over the medium term, ABARES says, chicken meat is projected to remain much cheaper than these competing meats.

It notes that the low cost of chicken has been driven by production efficiencies and that, not only will production costs remain comparatively low, but these low costs will also be reflected at retail level.

Higher-value chicken demand

Australia’s consumers are increasingly choosing fresh over frozen chickens.While demand for whole birds continues to remain strong, according to industry association the Australian Chicken Meat Federation (ACMF), in addition to moving from frozen to fresh whole birds, consumers are also increasingly choosing higher-value ready-to-cook chicken pieces.

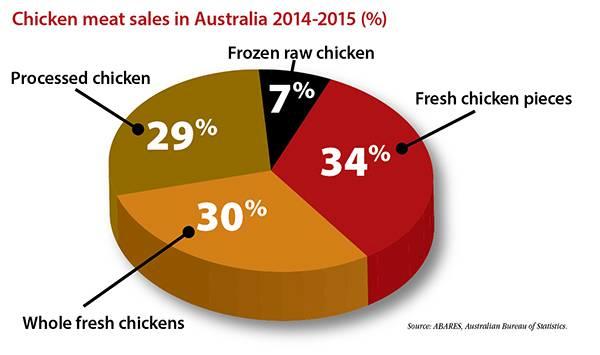

Fresh chicken pieces and whole birds now account for 64 percent of all chicken sales, with fresh chicken pieces now accounting for more than 50 percent of those sales.

Frozen raw chicken accounts for 7 percent of sales, while processed chicken accounts for the remaining 29 percent of sales.

Chicken production outlook

Chicken meat production grew by an average of almost 5 percent over the 10 years to 2013-14, and the sector now accounts for almost one-quarter of all meat production in the country, up from one-fifth in the previous decade.Along with consumption, production is forecast to carry on growing. Growth in output this year is expected to be in the region of 4 percent and is expected to reach 1.125 million tons. For 2015-16, this rate is expected to slow to 3 percent.

By 2019-20, however, Australia’s total chicken meat production is forecast to rise to 1.32 million tons, accounting for 28 percent of all meat produced in the country.

In contrast to beef and sheep meat production, Australia’s chicken meat industry is highly concentrated and vertically integrated.

Around 70 percent of chicken meat is supplied by two privately owned processing companies. The next five privately owned medium-size processors supply between 3 percent and 9 percent of the market, with a larger number of smaller processors accounting for the remainder.

Production and consumption of chicken meat in Australia are predicted to rise to the end of the decade, and chicken meat grows its margin of popularity in comparison with other meats.

No comments:

Post a Comment