Even though the avian flu outbreak of 2015 was the most costly foreign animal disease outbreak ever suffered by the U.S. poultry industry, the cage-free egg purchase pledges made by major foodservice and food processing companies in the U.S. will be the development that has the longest-lasting impact on U.S. egg producers.

New construction in 2016

In early returns from Egg Industry’s Top Egg Company Survey, it is apparent that much of the new housing being added in 2016 will be cage free. This shift is occurring as the industry is in a bit of a building boom. With surveys returned by mid-December, 26 egg producers with a combined total of around 100 million hens housed at the end of 2015 report they will add housing for nearly 4 million head of cage-free and 3 million head of cage-housed hens in 2016.

It is important to note that most cage-free projects that have been announced publicly involve new construction, not conversion of existing facilities. These projects are undertaken to meet increased demand for cage-free eggs without reducing the production of eggs from cage-housed hens.

Market demand for cage-free eggs is spurring a shift to cage-free housing, which may be the most significant development of 2016 for U.S. egg producers.

Anecdotal reports from California egg producers suggest that the California egg market will convert almost entirely to cage free over the next five years. Industry sources report that some California egg producers are taking steps to convert all of their existing cage housing to cage-free in anticipation of this market shift.

All hens housed in cages to produce eggs for the California market are provided a minimum of 116 square inches per hen versus 67 square inches for UEP Certified standard. Because of the lower housing density in cages for the California market, converting these facilities to cage free results in less of a production drop per square foot of floor space than it would for houses operated at the UEP Certified standard.

Egg production and price

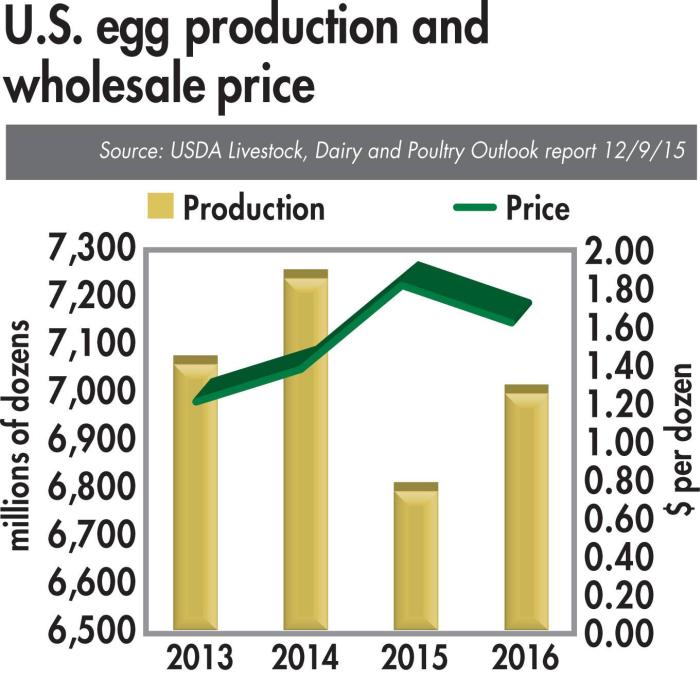

The avian flu outbreak in the Upper Midwest caused the loss of more than 40 million layers and pullets, which created an egg supply shortage in the U.S. and led to record high egg prices. The USDA estimates that U.S. egg production in 2015 fell to 6,803 million dozen eggs, down 6.5 percent from 2014 (Figure 1). The USDA is forecasting that 2016 egg production will be 7,015 million dozen, still below 2014 levels. But, industry sources expect U.S. weekly egg production to recover to 2014 levels by the end of 2016.

U.S. egg production is predicted to be below 2013 levels in 2016, and wholesale egg prices are predicted to remain at profitable levels for egg producers.

Feed ingredient costs

Egg producers benefited from reduced corn and soybean meal prices in 2015. Dr. Thomas Elam, economist, FarmEcon.com, said that he expected the USDA Agricultural Marketing Service (AMS) Central Illinois elevator daily cash bid price for corn to average $3.65 per bushel for the year in 2015. Prices ranged from a high of $4.15 per bushel to a low of $3.36 over the course of the year.

In 2016, Elam said he also expects the corn price to average around $3.65 per bushel as long as the U.S. has a crop of 13,250-14,000 million bushels. The December 9, 2015, USDA WASDE report estimated that the projected range for the 2015-16 crop year average corn farm price will be $3.35-3.95 per bushel.

The USDA AMS Decatur, Illinois, high protein soybean meal cash bid, daily average in 2015 reached a high of $420 per ton on January 5 and the low, as of December 7, was $294.50.

Elam said: “I look for 2016 weakness in meal based on a minor shift in acreage to beans and a continued strong dollar (negatively) affecting exports.”

The December 9, 2015, USDA WASDE report estimates the average soybean meal price will be in the $290-330 per ton range for the 2015-16 crop year.

When considering grain price forecast, Elam said, “As always, weather is the wild card.”

Competing animal proteins

Elam estimates chicken and pork will be in relative oversupply situations in the U.S. in 2016, meaning production costs will reach or at times exceed market prices for these meats. “I look for very small margins next year, and some months showing losses,” he said.

The supply and demand situation will be better for turkey and cattle producers in 2016, according to Elam. “The turkey breeding flock will not be back fully online until late in the second quarter of 2016, slaughter volume will be up three to four months after that,” he said. “Beef supplies will continue to grow in 2016, into 2017, and beyond. Growth rates of 2-4 percent are possible for 2016-17.”

Elam said: “Total protein disappearance for 2016 is forecast to be up 2-3 pounds from this year and a whopping 11-12 pounds from 2014. That is a large increase in a short period of time. Look for 2017 production growth limited by profitability across all meats.”

No comments:

Post a Comment