Although the population overall will be higher in the coming decade, its growth rate around the world will slow from the current world average of 1.1 percent annually. The growth rate in the OECD region, which sits at half that of the world’s population growth rate, will also slow. Population growth in developing countries will remain nearly double that of developed regions. With a higher population and poultry meat’s increasing acceptance in diets, poultry meat consumption will near 133 million metric tons in 2024, FAO projects. This accounts for nearly half of the 1.4 percent increase (51 million metric tons) in consumption of all meats by 2024. Increased consumption worldwide will also be aided by rising incomes and lower meat prices, both in nominal and real terms, which are expected to fall from recent record highs and stabilize over the outlook period. Although nominal prices will slightly rise by the end of the outlook period, real poultry meat prices are projected to trend slightly lower thanks to the combined effects of lower economic growth and lower feed costs.

Lowering feed costs aid poultry markets worldwide

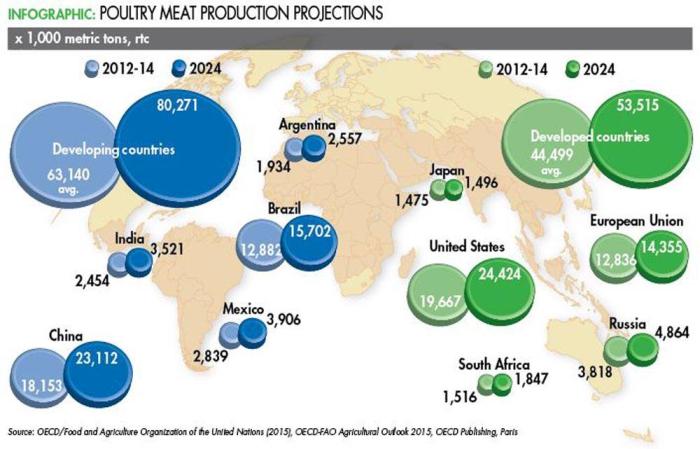

Over the next few years, meat producers will find the output meat price-to-protein feed price ratio for beef, pig and poultry meat will remain favorable compared to the previous period and sharp increase in 2014. This decline in feed costs and rise in meat output will enable developing countries in particular to increase their output through a more intensive use of protein meal in feed rations. By 2024, developing countries, excluding those least-developed countries, will account for 58 percent of the additional global poultry meat output. For example, Mexico’s production over the next 10 years is projected to grow by 2.95 percent – among the highest poultry production growth rates around the world – to more than 3,900 thousand metric tons in 2024. Likewise, China will experience growth of about 2.65 percent over the next decade to 23,000 thousand metric tons (see Infographic). In contrast, developed regions will be challenged to comply with more stringent environmental and animal welfare regulations, limiting expansion possibilities and slowing growth.

Developing countries will account for the majority of growth in poultry meat production over the next 10 years.

One developed region forecast to see growth over the outlook period in production, consumption and trade is Brazil, which is among the world’s largest producers and exporters of poultry meat. A combination of favorable exchange rates with the Brazilian real’s depreciation relative to the U.S. dollar, lower feed costs globally, improved animal genetics and nutrition, and increasing international and domestic demand are projected by FAO to continue Brazil’s fast growth in the meat market. In fact, poultry meat production’s share will account for more than half of this projected increase in total Brazilian meat output. The country’s increase in per capita meat consumption to 83 kg per person in 2024 (an extra 5.8 kg per person relative to the base period) will also be largely fueled by additional consumption of poultry meat. Rising domestic consumption aside, the country is also preparing to supply poultry meat to the growing population in the rest of the world; exports will continue to expand throughout the next decade to 5.3 million metric tons in 2024, bringing Brazil’s share of the world poultry market to just above 31 percent, says FAO.

Worldwide, on the other hand, growth in meat trade is projected to decelerate compared to the past decade, though the growth that is seen will continue to be led by poultry meat. Developed countries, according to FAO, will hold slightly less than half of the share of global meat exports by 2024, as traditionally importing countries expand their domestic production. International meat trade will be affected by a number of factors over the outlook period. Trade policies and the potential implementation of different bilateral trade agreements, coupled with the potential for animal disease outbreaks as in the case of avian influenza in the United States at the end of 2014 and beginning of 2015, could change the export landscape considerably over the next decade.

View interactive charts and download the datasets in the Market Data section of WATTAgNet:

Average annual percent change in world population 2012-14 to 2024

World poultry meat price projections to 2024

Meat price to feed price ratios by meat type 1994-2024

Production, consumption and exports of poultry meat in Brazil 2014-24

Poultry meat market projections by region to 2024

No comments:

Post a Comment